Top 7 Student loan apps in India 2024 (Instant Loans)

What is Loan apps ?

Loan apps are mobile applications that allow you to borrow money from lenders directly through your phone. They typically offer a faster and more convenient borrowing experience than traditional banks, with some apps even providing instant loan approvals and disbursements.

What is Student Loan Apps?

Student loan apps are mobile applications that allow students to borrow money for educational expenses. These apps typically offer quick and easy application processes, with minimal documentation required. They often cater to students with limited credit history or traditional banking options.

Here’s a breakdown of their key features:

- Convenience: Apply for loans directly from your smartphone, often with instant approval decisions.

- Smaller loan amounts: Focus on short-term borrowing for specific needs like textbooks, housing deposits, or emergencies, rather than covering entire tuition fees.

- Flexible repayment terms: Choose repayment schedules that fit your budget, often within a few months to a year.

- Potentially higher interest rates: Compared to traditional student loans, interest rates on app-based loans can be higher, so it’s crucial to compare options carefully.

Think of student loan apps as a financial bridge for immediate needs, not a long-term solution for major education expenses.

Here are some additional things to keep in mind:

- Eligibility requirements: These apps often have specific eligibility criteria, such as age, enrollment status, and minimum credit score.

- Fees and charges: Be aware of any processing fees, late payment penalties, or other charges associated with the loan.

- Building credit: Responsible borrowing and repayment through these apps can help build your credit history, which can be beneficial in the future.

Instant Student Loan Apps in India in 2024: RBI Registration, Authentication, and Low Interest Rates

Here are 7 Top popular instant student loan apps in India that are RBI registered:

| Apps Nane | Download Link | USE Referral Code Win a Special Bonus Direct Bank Account |

| StuCred | Click Here – Download | Code: RAQ13JX Earn up to Rs. 100 |

| Slice Borrow | Click Here – Download | – |

| Pocketly | Click Here – Download | Earn Rs. 25 |

| Moneyview | Click Here – Download | Code: SUBH5QM6 Receive Rs. 200 Direct Bank Account |

| KreditBee | Click Here – Download | Code: SUBCRETQY |

| True Balance | Click Here – Download | – |

| mPokket | Click Here – Download | – |

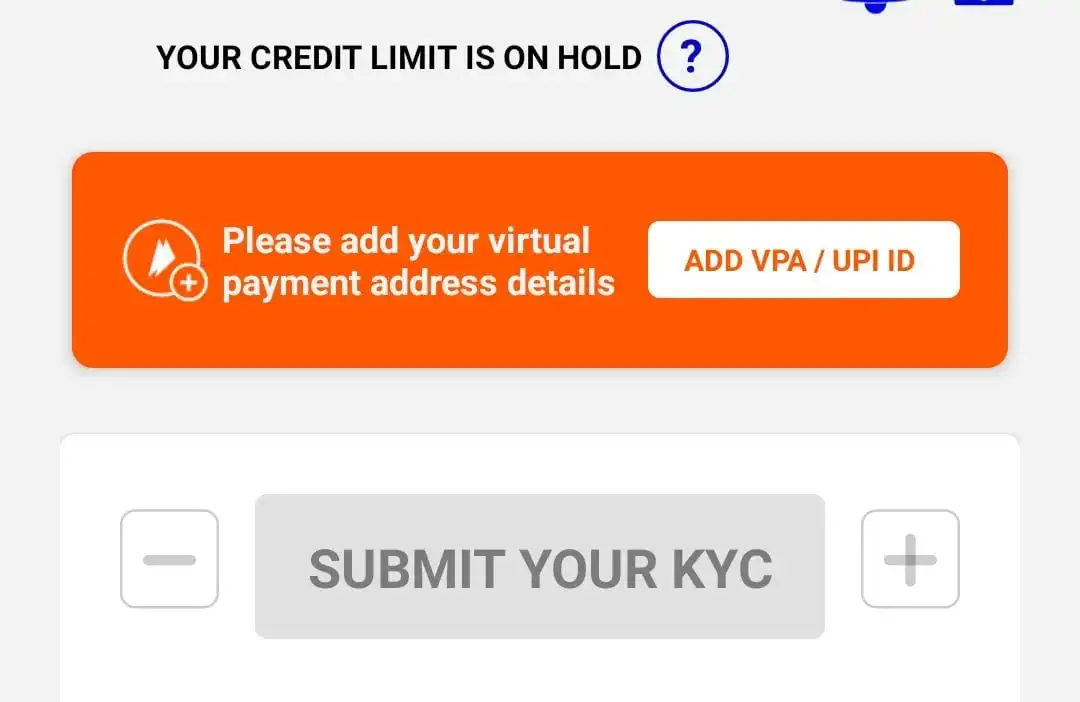

1. Top Student Loan App: StuCred (Highest Trustability)

| Feature | Details |

|---|---|

| Rank | 1st |

| Reason for Rank | Highest Trustability |

| User Base | Used by students from popular Indian colleges |

| Credit Limit | Dynamically adjusts based on loan repayment performance |

| Bank Transfer Method | UPI only |

Loan Details:

| Feature | Details |

|---|---|

| Loan Disbursal Time | 1-5 minutes |

| Required Documents | PAN card, Aadhar card, College ID |

| Loan Amount Range | ₹1,000 – ₹10,000 |

| Tenure | 2-3 months |

| Eligibility Criteria | College Student |

| Interest | 0% (effective interest rate varies) |

| Processing Fee | 6% per month (all-inclusive) |

| APR (Effective Interest Rate) | 72% |

Hey there!

I have an exciting opportunity to share with you. If you sign up using my referral link, you can earn up to ₹100 as a sign-up bonus. It’s a great way to get started! Join now, and let’s both earn rewards. Don’t miss out!Also, join StuCred’s Discord channel for exclusive offers, rewards, and early information on campaigns and contests happening on Instagram and our app.

Click here to join StuCred’s Discord channel: https://discord.gg/92e2bzHyz6

Click here to join StuCred and earn rewards: https://stucred.flyy.in/RAQ13JX

2. Slice Borrow: Instant Student Loans with Zero-Interest Option

Key Features:

| Feature | Details |

|---|---|

| Loan Type | Student Instant Loan |

| Interest Rate | Dynamic/user-specific, 0% for 1st month |

| Processing Fee | 3% of loan amount (discounts may apply) |

| Loan Disbursal Time | Instant |

| Required Documents | PAN card, College ID |

| Loan Amount Range | Up to ₹5 Lakh |

| Tenure | Up to 12 months |

| Eligibility Criteria | Student |

Loan Features and Potential Drawbacks

| Feature | Description | Potential Impact |

|---|---|---|

| Dynamic Interest Rates | Rates adjust based on your individual credit profile. | Uncertainty about future loan costs, potentially leading to higher expenses than anticipated. |

| Processing Fee | A fixed fee charged regardless of loan amount. | Increased upfront cost, especially for smaller loans, reducing the net borrowing amount. |

| Default Penalty | High penalty (30% of outstanding amount or ₹3000, whichever is lower) for missed payments. | Significant financial burden in case of payment delays, potentially impacting credit score and future borrowing options. |

3. Pocketly: Flexible Loan Options for Students

Key Features:

| Feature | Details |

|---|---|

| Early Closure | Close your loan anytime without penalty. |

| Flexible Repayment | Pay minimum EMIs and extend your tenure if needed. |

| Credit Building | Start with ₹600 credit limit, increase to ₹10,000 through timely repayments. |

| Low-tenure Loans | Similar to mPokket, offering short-term loans for students. |

Loan Details:

| Parameter | Information |

|---|---|

| Disbursal Time | Dynamic/User-specific |

| Required Documents | PAN card & Aadhar card |

| Loan Amount Range | ₹600 to ₹10,000 |

| Tenure | 2 to 4 months |

| Eligibility Criteria | 18-30 years old |

| Interest Rate | 1% to 3% per month |

| Processing Fee | ₹20 to ₹120 + GST |

| Refer & Earn | Upto ₹500 Cashback/referral |

| APR | 12% to 36% |

Hi! I am inviting you to experience the Best Loan App of India. Download Pocketly using my referral link to get ₹25 when you take your first loan.

https://pocketly.page.link/yduf

4. Moneyview: Flexible Loan Options for Students

Moneyviewis a popular Indian fintech platform that offers a variety of financial products, including personal loans for students. Here’s how Moneyviewcan be a good option for students looking for flexible loan options:

| Feature | Description |

|---|---|

| Flexible Loan Amounts | Borrow any amount between Rs. 5,000 to Rs. 10 lakhs, depending on your eligibility and needs. |

| Flexible Repayment Tenures | Choose a repayment tenure that suits your financial situation, ranging from 6 months to 5 years. |

| Competitive Interest Rates | Moneyview offers competitive interest rates starting at 1.33% per month (16% Annually*). |

| Instant Approval and Disbursal | Get your loan approved and disbursed within minutes if you have a good credit score and meet the eligibility criteria. |

| Minimal Documentation | No need for cumbersome paperwork. Just upload a few basic documents online. |

| Pre-approved Loan Limit | Get a pre-approved loan limit based on your profile, allowing you to easily withdraw funds whenever needed. |

| Flexible Interest Payment | Only pay interest on the amount you utilize, not the entire loan amount. |

| Easy Prepayment | Prepay your loan anytime without any penalty charges. |

| Mobile App | Manage your loan account conveniently through the Moneyview mobile app. |

Hey There! Did you know moneyview can help you get a Personal Loan of up to Rs.10,00,000 in minutes??! What’s more? Download the app & apply with this 🎁 SUBH5QM6 to WIN a SPECIAL BONUS 💸 https://moneyview.whizdm.com/share_lref?ref=SUBH5QM6

5. KreditBee Flexi Personal Loan – Ideal for Students

Details:

| Feature | Details |

|---|---|

| Loan Type | Flexi Personal Loan |

| Target Audience | Students in mid/last stages of graduation or pursuing higher education |

| Loan Disbursement Time | Approximately 15-20 minutes after application |

| Loan Amount Range | ₹1,300 to ₹50,000 |

| Tenure | 3 to 10 months |

| Interest Rate | 18% to 30% per annum |

| Annual Percentage Rate (APR) | Up to 70% |

| Processing Fee | 2.5% of loan amount, fixed between ₹85 to ₹1,800 + GST (Save with KreditBee Coupons and Refer & Earn) |

| Onboarding Fee (New Users) | ₹200 + GST |

| Required Documents | PAN card and Aadhar card/Passport |

| Eligibility Criteria | 21+ years old |

6. True Balance: Flexible Loan Options for Students in India

True Balance is a popular fintech platform in India offering financial services, including instant personal loans, potentially suitable for students. Here’s how True Balance might appeal to students seeking flexible loan options:

| Feature | Description |

|---|---|

| Flexible Loan Amounts | Borrow between Rs. 1,000 and Rs. 1 lakh, depending on your eligibility and needs. Ideal for smaller expenses or emergency situations. |

| Flexible Repayment Tenures | Choose repayment tenures between 3 and 12 months, manageable within your student budget. |

| Instant Approval and Disbursal | Quick approvals and disbursal within minutes, perfect for urgent needs. |

| Minimum Documentation | No extensive paperwork needed. Just upload PAN card and Aadhaar card. |

| Pre-Approved Loan Limit | Check your pre-approved limit through the app, offering access to funds when needed. |

| Mobile App | Manage your loan account conveniently through the True Balance mobile app. |

7. mPokket: Quick Loans for Students

Details:

| Feature | Description |

|---|---|

| Loan Approval Speed | Fast and efficient, typically within 2-5 minutes. |

| Loan Tenure | Short-term, ranging from 2 to 4 months, ideal for managing immediate needs. |

| Loan Amount | Flexible, starting at ₹500 and reaching up to ₹30,000 based on your credit history and repayment behavior. |

| Interest Rate | Competitive, ranging from 0% to 4% per month (142% APR max). |

| Processing Fee | Fixed between ₹50 and ₹200 + GST. |

| Eligibility | Open to students aged 18+ with a valid college ID. |

| Loan Disbursement | Direct to your bank account or Paytm wallet. |

| Required Documents | College ID, PAN card, and one of Aadhaar card, driving license, or voter ID. |

| App Name | APR | Interest Rate (per month) | Processing Fee (of loan amount) | Rewards (for timely repayments) | Trust Score (out of 10) |

|---|---|---|---|---|---|

| StuCred | 72% | 0% | 6% | Lucky Cash (bank transfer) | 8 |

| Slice Borrow | Uncertain (maybe up to 40%) | Uncertain (0% if paid within 1 month) | 3% | Free Interest for a month | 7 |

| Pocketly | Up to 36% | 1-3% | ₹20-₹120 + GST | Refer & Earn (up to ₹500 Cashback) | 5 |

| Moneyview | Variable (starting at 16% annually) | 1.33% | Varies | Not specified | 6 |

| KreditBee | Up to 70% | 1.5-2.5% | 2.5% | KreditBee Coupons | 6 |

| True Balance | Up to 36% | Up to 3% | Varies | Not specified | 6 |

| mPokket | Up to 142% | 0-4% | ₹50-₹200 + GST | mPokket Cashback | 5 |